President’s Message: Wouldn’t it be nice if all taxes were “voluntary”?

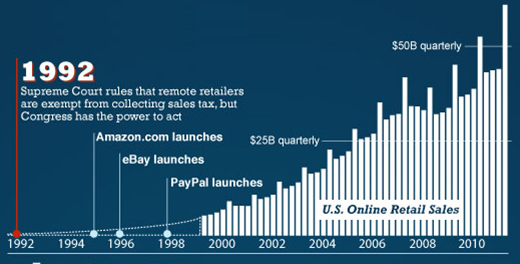

Typically, I steer clear of any politically-charged issue in my President’s Messages, but there is a bill currently pending in the Senate that falls into the “just plain common sense” category. The Marketplace Fairness Act deals with the problem of uncollected sales taxes from the sales of internet retailers that do not have a physical presence in the state in which the consumer makes the purchase. In my opinion, the loophole is the unintended consequence of a law which was passed over two decades ago…long before the impact of technology and internet sales.

The result today – $23 BILLION in uncollected sales tax revenue.

After a very lengthy campaign of a coalition of trade organizations led by the International Council of Shopping Centers (ICSC), the Senate is now taking up the Marketplace Fairness Act of 2013. The passage of this bill is critical to the Commercial Real Estate industry, brick-and-mortar retailers and perhaps most importantly, to our State. As an ICSC Trustee, I want to highlight some important information about this bill:

It levels the playing field for ALL retailers.

Local brick-and-mortar retailers have long been put at a tremendous disadvantage by an antiquated sales tax framework that clearly benefits online retailers. The current sales tax system is threatening our community retailers, which serve as the backbone of our local economies.

Courtesy of ICSC. Click to learn more.

It protects small online businesses.

The law exempts firms with less than $1 million in sales from collecting sales taxes, which would exempt 99% of all sellers and over 40% of all online retailers. It also requires states to streamline the collection process so it is not an undue burden.

It is NOT a new tax.

Sales tax on online purchases is not new; it’s already due and currently should be self-reported by the consumer. 98.6% of us don’t report…should we all go to jail? The Marketplace Fairness Act removes the burden on consumers by requiring online and catalog sellers to collect sales tax at time of purchase.

It promotes a more stable & efficient revenue stream for state & local governments to pay for projects and services.

Without the bill, states may have to raise other taxes for their in-state residents and businesses. Estimates of lost sales taxes in Louisiana alone due to internet sales range from $400 million to $800 million…and this figure will only grow exponentially with current demographic trends. This is a significant hole for a state with a $1.3 billion deficit to fill.

Courtesy of ICSC. Click to learn more.

This bipartisan legislation provides the federal solution necessary to close the online sales tax loophole and level the playing field for all retailers. The Marketplace Fairness Act is a simpler, more evenhanded and efficient sales tax system that will bring numerous benefits to our economy. This is a critical issue that must be dealt with sometime. If not, we are simply kicking the can down the road. To me, it is just common sense.

Read More:

Yes, It’s Time for an Internet Sales Tax

5 Things You Should Know About the Long Overdue Online Sales Tax Bill

Internet sales tax long overdue: Our view