Marketplace Fairness Act Passes Senate

After many years of campaigning by ICSC and other trade organizations, the U.S. Senate voted 69 to 27 yesterday to approve S. 743, “The Marketplace Fairness Act of 2013,” moving the legislation one step closer to enactment. As I mentioned in my recent President’s Message, the passage of this bill is critical to the Commercial Real Estate industry, brick-and-mortar retailers and perhaps more importantly, to our State.

There is more work to be done before the Marketplace Fairness Act can become law. Now it must be approved by the House of Representatives, so there will be more challenges ahead and much education that needs to take place. I encourage you to contact your Representative today!

President’s Message: Wouldn’t it be nice if all taxes were “voluntary”?

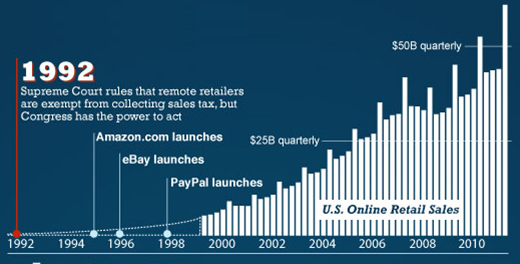

Typically, I steer clear of any politically-charged issue in my President’s Messages, but there is a bill currently pending in the Senate that falls into the “just plain common sense” category. The Marketplace Fairness Act deals with the problem of uncollected sales taxes from the sales of internet retailers that do not have a physical presence in the state in which the consumer makes the purchase. In my opinion, the loophole is the unintended consequence of a law which was passed over two decades ago…long before the impact of technology and internet sales.

The result today – $23 BILLION in uncollected sales tax revenue.

After a very lengthy campaign of a coalition of trade organizations led by the International Council of Shopping Centers (ICSC), the Senate is now taking up the Marketplace Fairness Act of 2013. The passage of this bill is critical to the Commercial Real Estate industry, brick-and-mortar retailers and perhaps most importantly, to our State. As an ICSC Trustee, I want to highlight some important information about this bill:

It levels the playing field for ALL retailers.

Local brick-and-mortar retailers have long been put at a tremendous disadvantage by an antiquated sales tax framework that clearly benefits online retailers. The current sales tax system is threatening our community retailers, which serve as the backbone of our local economies.

Courtesy of ICSC. Click to learn more.

It protects small online businesses.

The law exempts firms with less than $1 million in sales from collecting sales taxes, which would exempt 99% of all sellers and over 40% of all online retailers. It also requires states to streamline the collection process so it is not an undue burden.

It is NOT a new tax.

Sales tax on online purchases is not new; it’s already due and currently should be self-reported by the consumer. 98.6% of us don’t report…should we all go to jail? The Marketplace Fairness Act removes the burden on consumers by requiring online and catalog sellers to collect sales tax at time of purchase.

It promotes a more stable & efficient revenue stream for state & local governments to pay for projects and services.

Without the bill, states may have to raise other taxes for their in-state residents and businesses. Estimates of lost sales taxes in Louisiana alone due to internet sales range from $400 million to $800 million…and this figure will only grow exponentially with current demographic trends. This is a significant hole for a state with a $1.3 billion deficit to fill.

Courtesy of ICSC. Click to learn more.

This bipartisan legislation provides the federal solution necessary to close the online sales tax loophole and level the playing field for all retailers. The Marketplace Fairness Act is a simpler, more evenhanded and efficient sales tax system that will bring numerous benefits to our economy. This is a critical issue that must be dealt with sometime. If not, we are simply kicking the can down the road. To me, it is just common sense.

Read More:

Yes, It’s Time for an Internet Sales Tax

5 Things You Should Know About the Long Overdue Online Sales Tax Bill

Internet sales tax long overdue: Our view

IBM – What a Win for Baton Rouge!

IBM‘s recent announcement that they will open an 800-job technology center in downtown Baton Rouge is a HUGE game changer for Baton Rouge, LSU and Louisiana. Along with the new, well-paying, tech-sector jobs that IBM will bring, the state has committed to fund an expansion of LSU’s computer science program, which will help to provide a well-trained workforce. Additionally, a mixed-use building to be developed on the river and occupied by IBM will transform the skyline of downtown Baton Rouge.

This economic win would not have been possible without the hard work and collaboration between the Baton Rouge Area Chamber (BRAC), the City/Parish of East Baton Rouge, Louisiana Economic Development (LED), Louisiana State University, the Baton Rouge Area Foundation (BRAF) and others that played a key role in successfully luring IBM to Baton Rouge.

Read more details in BRAC’s Press Release and LED’s Press Release.

President’s Message: Lucky 13!

We started the year with the acquisition of Avant Properties in Shreveport, Louisiana and capped it off with our recently announced joint venture development deal with CBL Properties of the Fremaux Town Center in Slidell, Louisiana.

In between those two milestone bookends, consider the following list of other accomplishments:

- The kickoff of Mid-City Market in New Orleans.

- The historic redevelopment of the American Legion Building into a state of the art Walgreens Drug Store on Magazine Street in New Orleans.

- The opening of The Fresh Market on St. Charles Avenue in New Orleans.

- The $24 million acquisition of Tiger Manor Apartments in Baton Rouge.

- The securing of two new Walgreens development deals in Terrytown & Gulfport.

- The opening of Sam’s Club at River Chase in Covington.

- The successful closing of over $100 million in financing.

- The increase of over 16% of our commercial brokerage volume.

And while all of this was happening, we were also able to implement a new, state-of-the-art accounting software, introduce a brand new corporate website and complete a major restructuring of the company.

These accomplishments are all tributes to the outstanding team of professionals at Stirling Properties. We are now setting our sights on an outstanding new year and plan on making some additional major announcements soon. 2013 will certainly be a banner year – and lucky too.

East Coast, West Coast…Emergence of the Third Coast

One quote in this article that is particularly striking to me is regarding the education system:

In a new report, government efficiency expert David Osborne describes New Orleans’s reforms as a “breakthrough.” The results, he says, are “spectacular: test scores, graduation rates, college-going rates, and public approval have more than doubled in five years.” He adds, “I believe this is the single most important experiment in American education today.”

Sam’s Club Opening a Record-Breaking Success!

Monday night was the store’s soft opening and it was equally crowded. The Sam’s Club parking lot was full, plus there were about 300 extra cars parked on the street and in nearby lots. The manager, Chris Cuevas, told me that the soft opening was a record for Sam’s Club.

I wouldn’t be surprised if this store sets many more records.